Day 30: Summing up

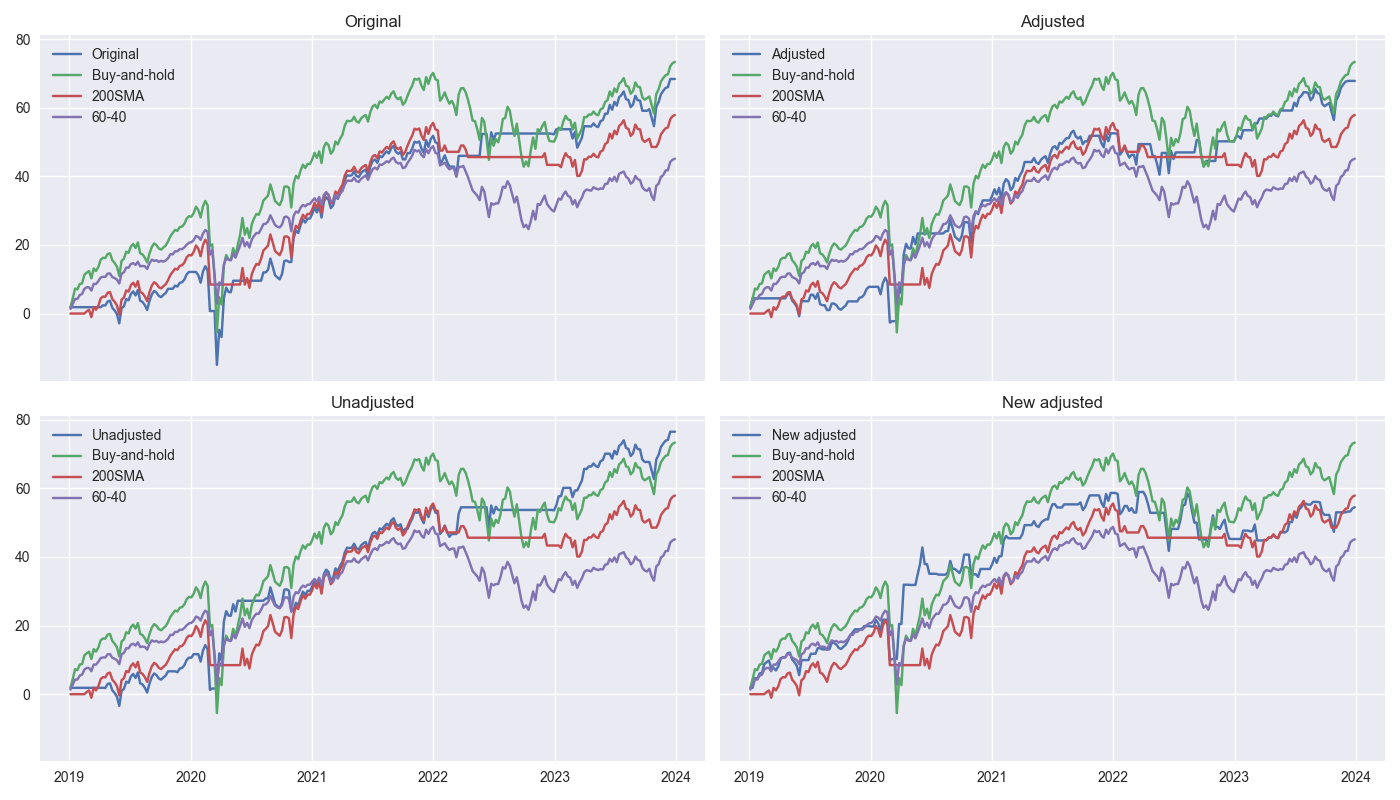

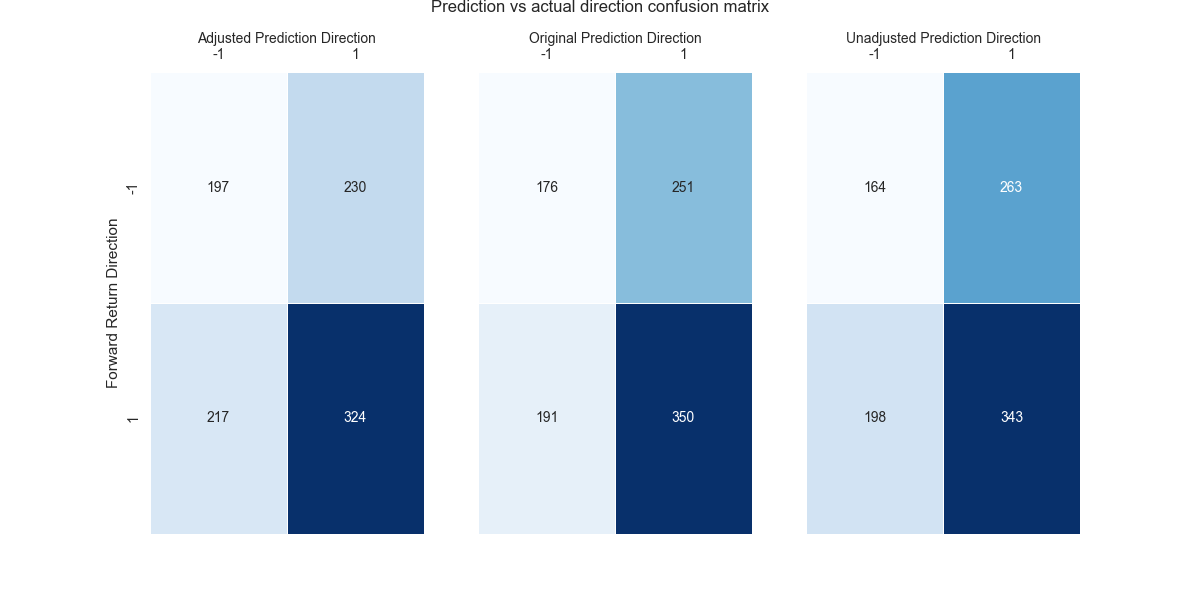

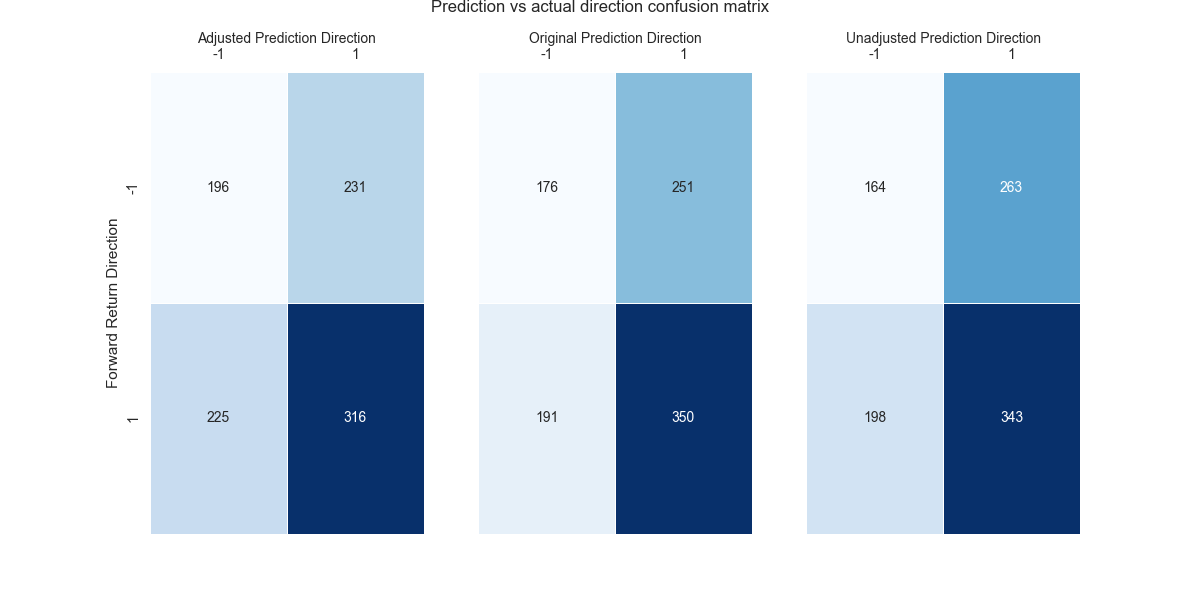

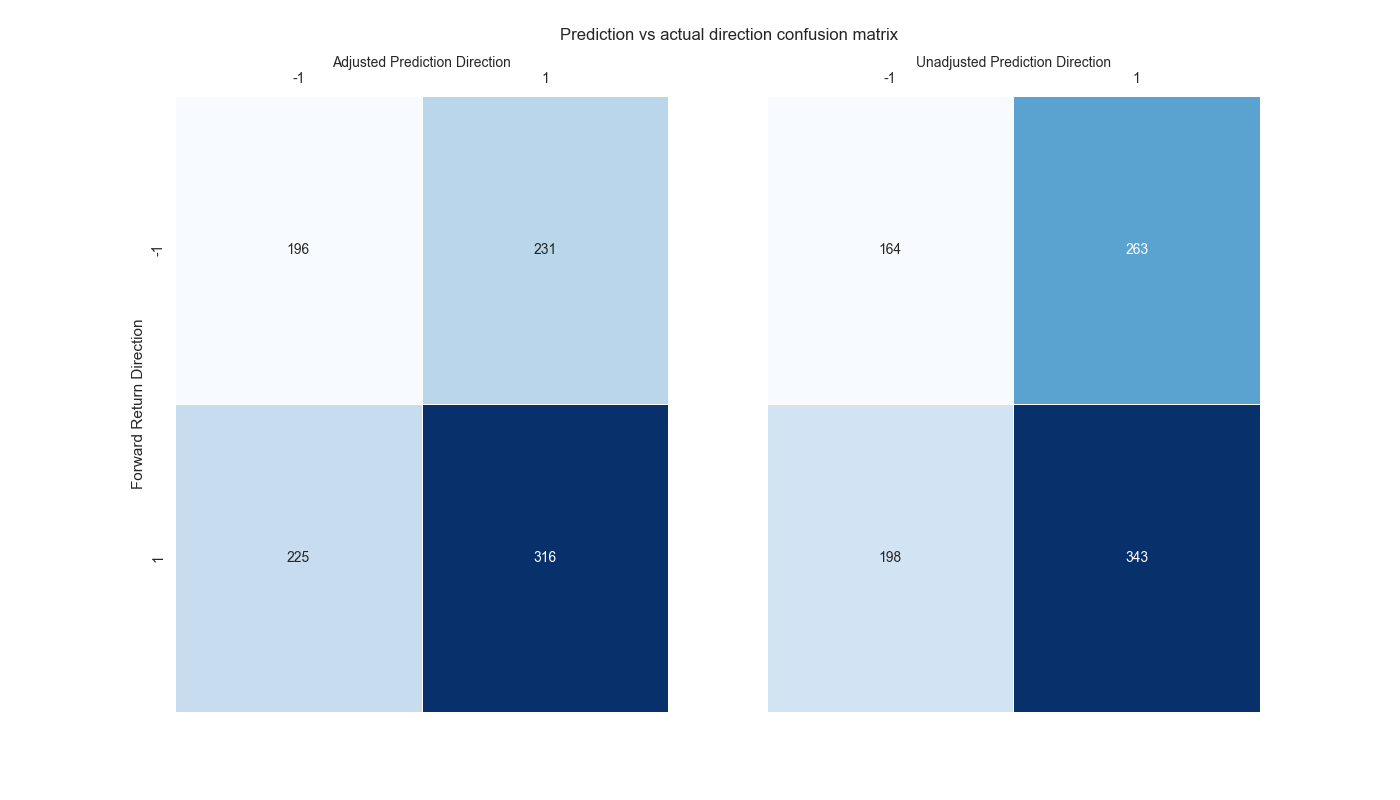

On Day 29, we conducted our out-of-sample test on the four strategies and found that the adjusted strategy came out on top. We made this conclusion after ranking a cross section of the following metrics: cumulative return, Sharpe Ratio, and max draw...